property tax bill las vegas nevada

With market values established Las Vegas along with other in-county public districts will calculate tax levies alone. As highly respected unbiased third-party specialists in property tax consulting management valuations and appeals our clients depend on us to.

/cloudfront-us-east-1.images.arcpublishing.com/gray/NUP34L5V6RCOPLDO5MHJB4BXHE.png)

Clark County Mails Property Tax Bills After Correction Frenzy

One cost that is often overlooked is property tax.

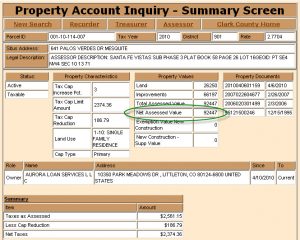

. 3 beds 25 baths 1380 sq. Box 551510 Las Vegas NV 89155-1510 If you pay in person you can go to the Clark County Treasurers Office and pay. Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be.

The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. LAS VEGAS KTNV Clark County residents were mailed the initial real property tax bills over the weekend and should be arriving in mailboxes as early as this week. The appeal form must be obtained from the county assessor and filled out completely in Clark County call 702 455-3891.

10444 Wild Bill Ct Las Vegas NV 89129 359999 MLS 2450290 Located in quaint and quiet gated Sierra Crossings in the Northwest with a. The address is. To ensure timely and accurate.

Residents can see what their property tax percentage is on their bill or statement. The following FAQs answer key questions about. 18 2022 at 242 PM PDT.

Clark County Treasurers Office PO. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues. The assessed value is equal to 35 of the taxable value.

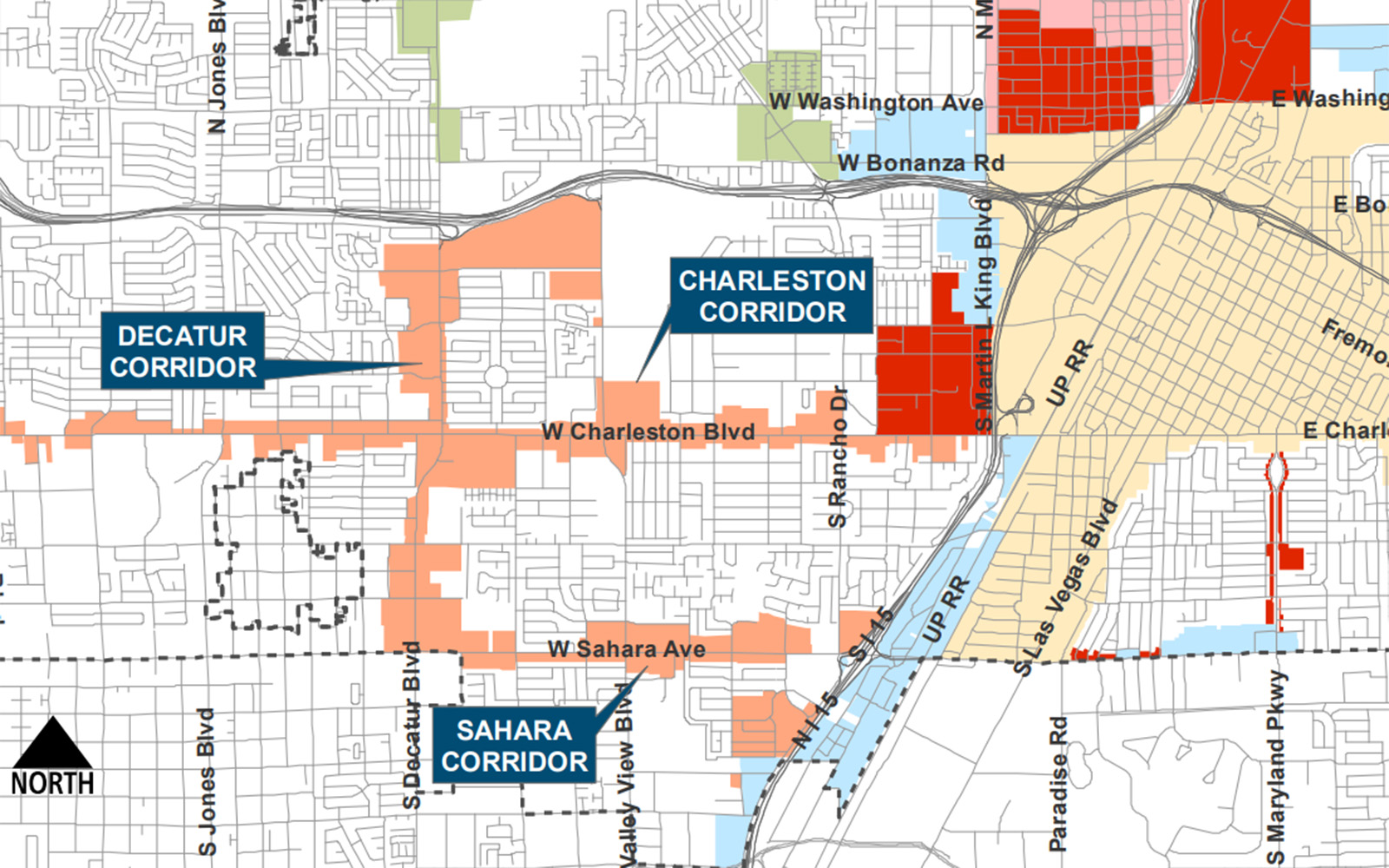

A composite rate will produce expected total tax receipts and also. Las Vegas Nevada 89155-1220. In Clark County Nevada property tax rates are among the lowest in the.

Checks for real property tax payments should be made payable to Clark County Treasurer. FOX5 - Clark County mailed out initial real property tax bills over the weekend following a frenzy of residents. If you do not receive your tax bill by August 1st each year please use the automated telephone system.

Be prepared to provide the parcel ID number. Las Vegas - Property Tax Services.

Taxpayer Information Henderson Nv

Nevada Property Tax Bills Very Vintage Vegas Las Vegas Mid Century Modern Homes

Living In Las Vegas Pros And Cons Landing

Why Car Rental Bills Are So High Taxes And Sneaky Fees Los Angeles Times

Free Nevada Vehicle Bill Of Sale Form Vp 104 Pdf Eforms

Nevada Is No 2 Among The Most Tax Friendly States Livewellvegas Com

High Property Taxes Why You Re Paying So Much Money

Nevada Records Another 1 Billion Month But Las Vegas Plods Through A Cautious Recovery

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

The Best Property Management Companies In Las Vegas Nevada Of 2022 Propertymanagement Com

Initial Real Property Tax Bills Mailed To Clark County Residents Las Vegas Review Journal

Las Vegas Vs Clark County There Are Differences Between Living In City Limits And Unincorporated County Land Las Vegas Sun Newspaper

Estate Planning Law Las Vegas Nv Integrity Law

U S Cities With The Highest Property Taxes

3410 Villa Hermosa Dr Las Vegas Nv 89121 Realtor Com